Most people would assume that the profit or loss from holding share CFDs denominated in a foreign currency would equate to the result that one would get from holding the underlying physical shares, however, this is definitely not so and can be an expensive lesson to those uninitiated in the ways of CFD providers.

An example will illustrate what I’m talking about.

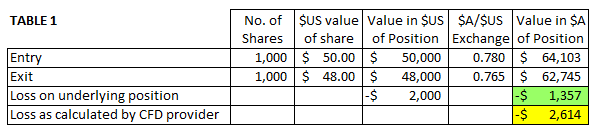

In Table 1 below, we take the example of someone based in Australia (with an account held in Australian dollars) buying 1,000 shares in a US listed company at $US 50.00 per share. The cost of these shares is $US 50,000 and at the time the trade is entered into, the $A is worth $US 0.78, so the Australian dollar cost is $64,103.

When the trade is closed, the price of the stock has fallen to $US 48.00 per share, but the Australian dollar has also fallen against the US dollar and is now worth $US 0.765. Therefore, the position’s value in Australian dollars is $62,745 and the actual loss in Australian dollars is $1,358 ($62,745 less $64,103). This is the result that would have been achieved if physical shares were being held.

However, the trader holding CFDs, is in for a nasty surprise because their CFD provider simply calculates the trade loss as $US 2,000 ($US 50,000 original cost of the position less $US 48,000 closing value of the position) and then simply converts that loss at the current exchange rate (i.e. 0.765), leaving the trader with a $2,614 loss (or twice what they would have had if they had held the physical shares)!

Back in late 2013, I wrote about a trade I had done in Berkshire Hathaway. Had I been holding that trade as CFDs (which I was not), my profit would have been only 60% or so of the actual profit that I made. So, this is an important concept to understand for those of you who are new to trading CFDs over foreign companies.

Table 2 gives an example of making a $US 2 profit on each share (the opposite of the example in Table 1). Once again, the unfortunate trader has a worse result than he would have experienced had he been holding the physical shares.

There are three clear lessons from this:

1. Holding CFDs over

foreign shares WILL NOT give you the same result as holding the underlying

physical shares traded on an exchange (if you hold your CFD account in your

home currency);

2. If your home

currency is depreciating against the currency in which the foreign share is

denominated in, you will ALWAYS achieve a worse result than holding the

physical shares (the opposite is true if your home currency is appreciating,

your profits will be larger and your losses smaller); and

3. If you wish to

trade CFDs over foreign shares, you may want to hold the funds in your CFD

account in that foreign currency to avoid the above issue.

CFD traders would be advised to be very cautious trading foreign CFDs with Australian dollar denominated accounts in the current environment.

No comments:

Post a Comment